Looking into China’s mRNA Vaccine Industry: A Latecomer’s Prospects

This article was originally posted on Pharma Boardroom

May 31, 2023 | Justin Wu, 2023 Spring Intern, Bridge Consulting

Bridge Consulting examines the opportunities and challenges ahead for China’s mRNA vaccine industry in the post-COVID era. Having eschewed foreign-made mRNA products from Pfizer/BioNTech and Moderna during the peak of the pandemic in the hope of securing domestic alternatives, China and its sizeable biopharma industry now face a challenging path ahead to catch up to Western dominance in this important field.

Three years since the pandemic begun, the WHO has finally ended the global emergency status for COVID-19. Yet only recently was China’s first homegrown mRNA COVID-19 vaccine by CSPC Pharmaceutical Group approved in March 2023 and later rolled out on May 14. Despite repeated offerings of mRNA vaccines from other countries, China has remained steadfast in its commitment to achieving technological self-reliance – i.e., distributing domestically-developed vaccines whilst heavily investing in its own mRNA industry.

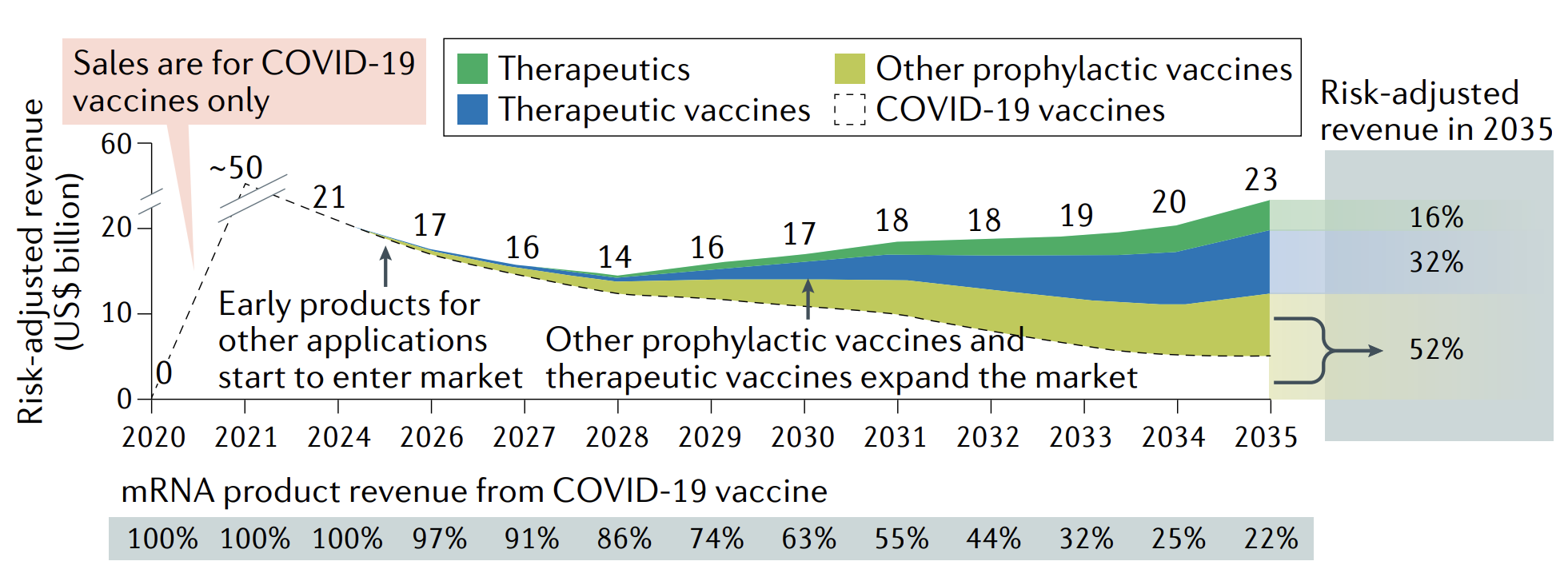

With great application prospects and advantages over conventional vaccine approaches, mRNA vaccines have been recognized as the next step in vaccinology. While mRNA technology has evolved over the decades, it was the COVID-19 pandemic that really brought mRNA-based vaccines to their prime time. In 2021, mRNA vaccines brought USD 50 billion in revenue to the three global mRNA vaccine giants – i.e., Pfizer, Moderna, and BioNTech. The Insight Ace Analytic predicted that the global mRNA manufacturing and synthesis services market would reach USD 22.6 billion in 2031.

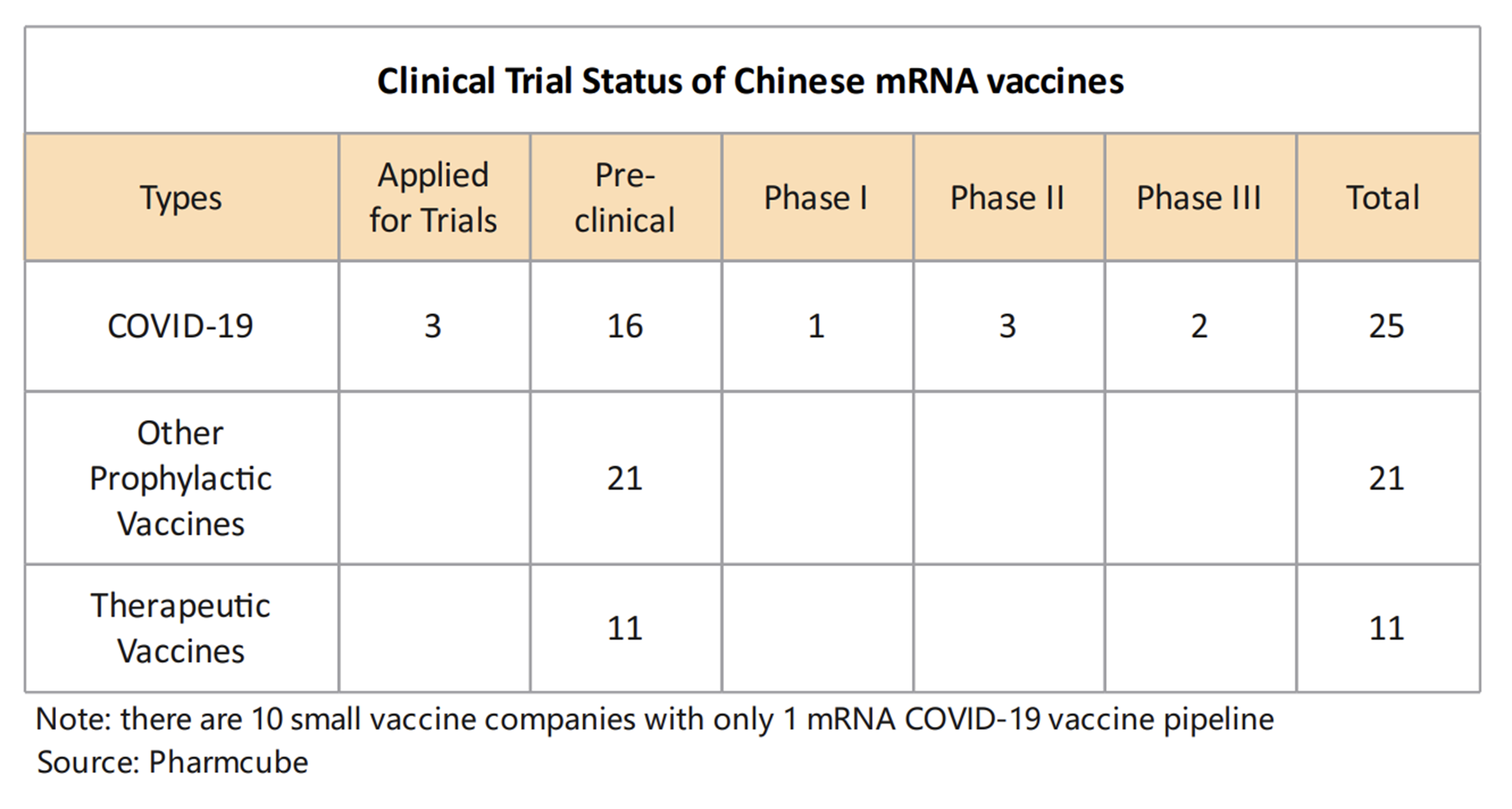

As the latest generation of vaccine technologies, the value and application prospects of mRNA technology have also been recognized by Chinese stakeholders, sparking an “mRNA gold rush”. As of March 2023, 57 homegrown mRNA vaccines are in various phases of clinical trials, with at least 34 companies or institutions focusing on mRNA R&D.

Data as of March 2023. There are 10 small vaccine companies with only 1 mRNA COVID-19 pipeline | Source: Pharmcube

Nonetheless, due to the end of “zero-COVID” and subsequent mass infections among the Chinese population in Winter 2022 and a global vaccine surplus, the demand for COVID-19 vaccines has plummeted. For instance, CanSino Biologics, a Chinese pharmaceutical that got a COVID-19 boost, reported an RMB 902 million (USD 130 million) loss in 2022. Additionally, its subsidiary CanSino SPH was said to have suspended its vaccine production in April 2023. A grim-looking COVID-19 vaccine market with limited profit-making potential has raised many concerns: Would it be too late for homegrown mRNA COVID-19 vaccines that are still in the pipeline? What are the odds for Chinese biotechs focusing on mRNA technology to survive and thrive in the post-pandemic era?

Closed Gates for Foreign mRNA Vaccines

There are essentially two routes for foreign pharmaceuticals to distribute their vaccine in the Chinese mainland, conditional upon regulatory approvals: establishing a manufacturing facility with a domestic partner while keeping control of the key technology or going for a complete technology transfer.

BioNTech took the former option. As early as March 2020, Shanghai Fosun Pharma had signed deals with BioNTech to commercialize its mRNA COVID-19 vaccines in Greater China. A Caixin report further disclosed Fosun’s plan to construct a China-based vaccine manufacturing facility with a first-phase production capacity of 200 million doses. In May 2021, Fosun announced the intention to form a joint venture with BioNTech to make up to 1 billion doses of mRNA vaccine a year. Yet the regulatory approval to commercialize Comirnaty in the Chinese mainland remained in limbo, despite the publication of data from several phase I and a phase II clinical trial on immunogenicity and safety of the vaccine in the Chinese population.

Meanwhile, some foreign vaccine companies either opted for or were pressed to take the latter. Providence Therapeutics carried out a full tech transfer of its vaccine candidate to Everest Medicines. At the same time, Moderna declined the National Medical Products Administration (NMPA)’s request to carry out a full technology transfer due to commercial and safety concerns. Yet news reports suggested the negotiations on introducing Moderna’s mRNA vaccines continued.

In the diplomatic sphere, China had turned down almost all the EU and US mRNA vaccine offers, except the case of the Sino-German vaccine swap in December 2022 – i.e., the deal to offer BioNTech mRNA vaccines to German expatriates in China, and vice versa.

As intricate and confusing as the Chinese stance may seem from a public health standpoint, since mRNA shots have proven more effective than domestic inactivated jabs, the underlying goal could be simple: achieving technological self-reliance to enhance public security. Embodied in the recent Ministry of Science and Technology (MOST) reform, this idea became a fundamental policy and a top priority after last year’s 20th Party Congress. Similarly in the US, back in September 2022, the President signed an executive order to boost domestic manufacturing in the US biotech industry to mitigate risks posed by foreign competitors in the biotech supply chain.

After all, not importing and relying on foreign mRNA vaccines while clinging to homegrown ones aligns with Beijing’s vision. It also won time for domestic mRNA vaccine companies, particularly those smaller players, to select the antibody and optimize mRNA development.

An Emerging Domestic mRNA Vaccine Upstream Industry

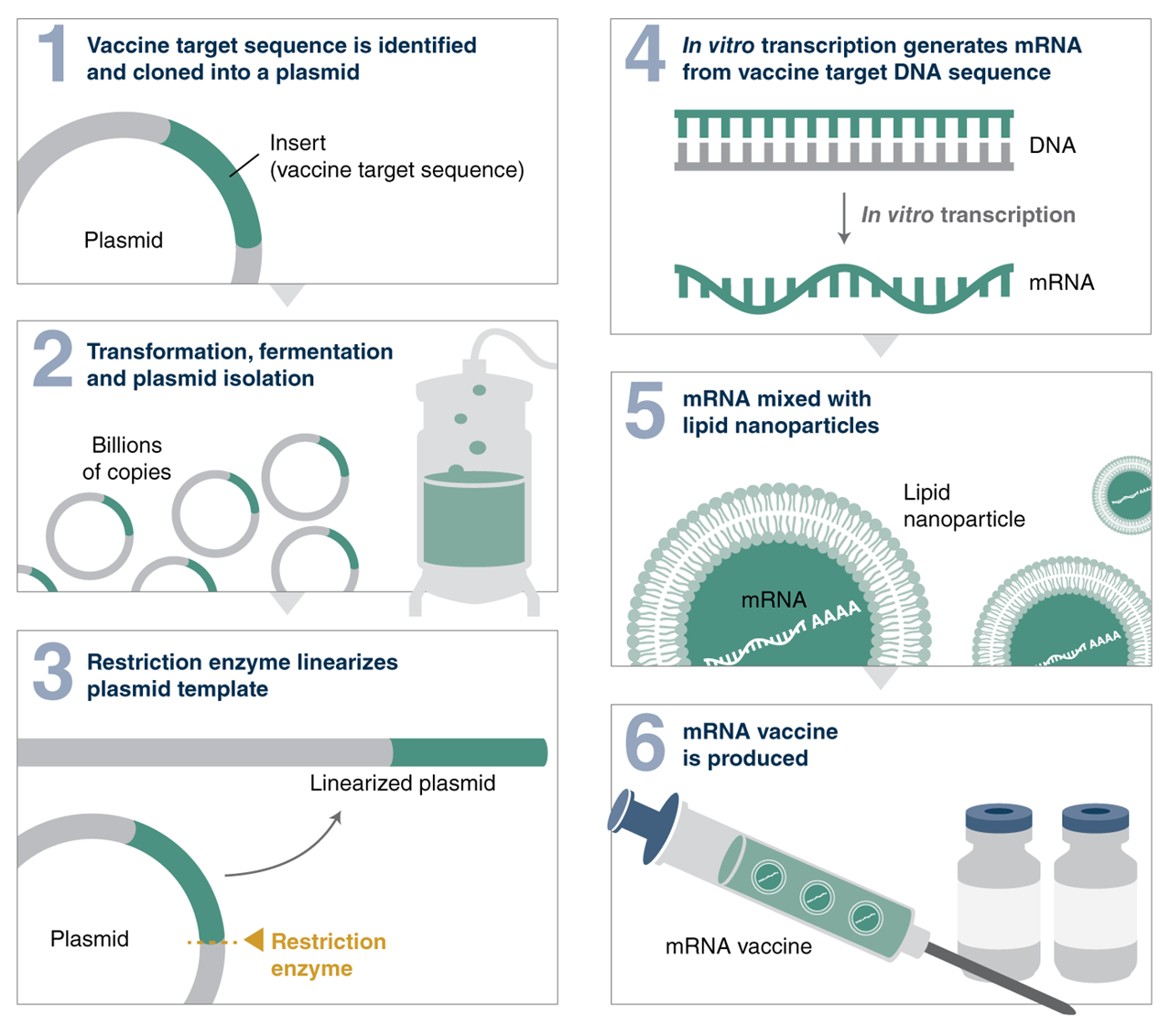

The domestic enthusiasm for mRNA vaccines has opened a window to build up a whole mRNA industrial chain and overcome the four technical barriers to the production of mRNA vaccines:

- mRNA transcription and modification (56% of the cost)

- equipment and consumables (24% of the cost)

- raw materials of lipid nanoparticles (LNPs) (8% of the cost)

- plasmids (9% of the cost)

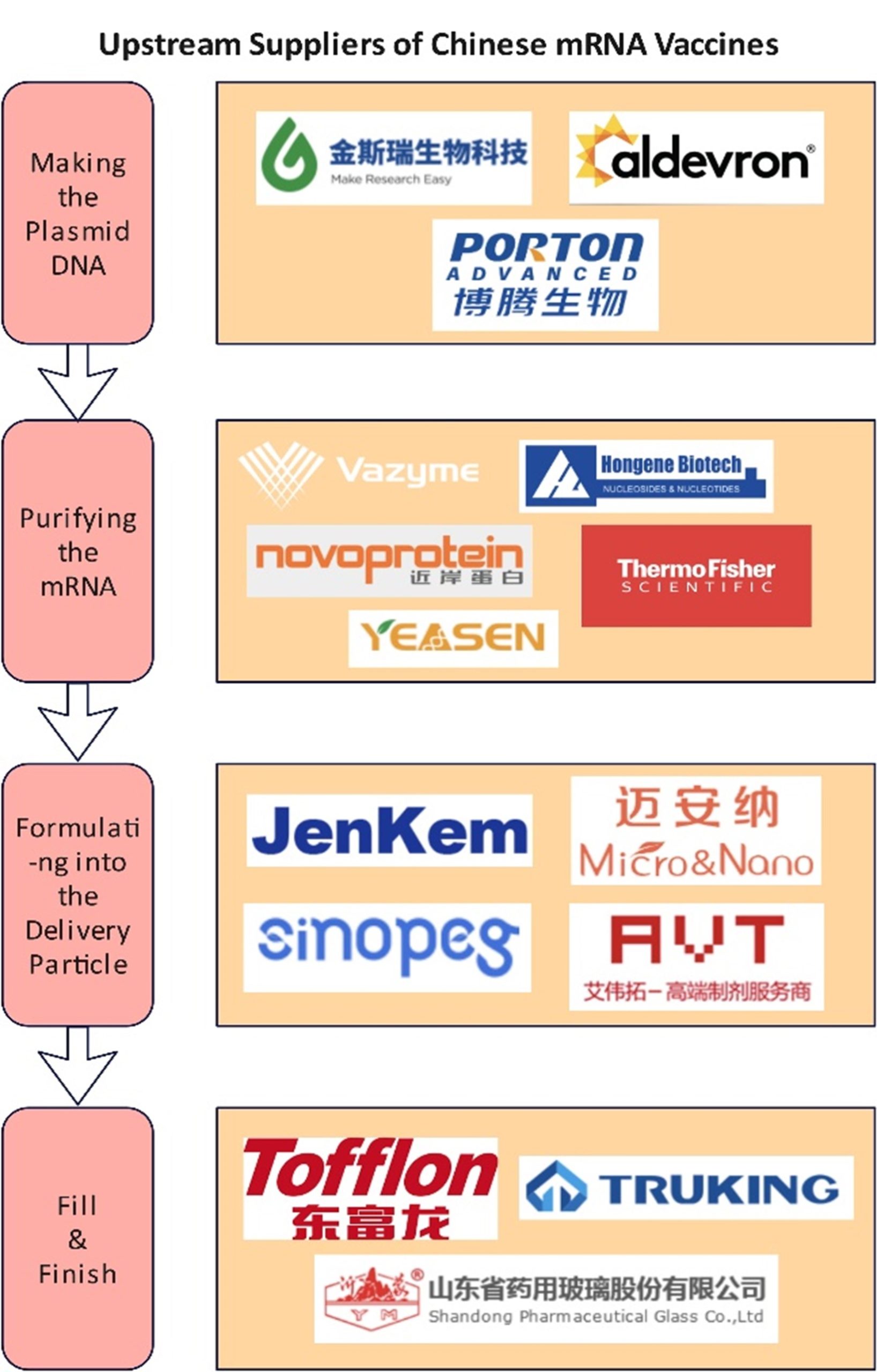

Indeed, the leading domestic companies have achieved a high level of domestic substitution in the raw materials and plasmids for mRNA in vitro transcription (IVT). For instance, GenScript, headquartered in Nanjing, supplies GMP plasmids for all domestic mRNA vaccine companies. Hongene Biotech, headquartered in Shanghai, is currently the world’s biggest supplier of nucleotides, a key raw material for mRNA synthesis.

A simplified workflow for mRNA vaccine production | Source: New England Biolabs

The company took up to 70% of the global market share in FY2020, with annual revenue reaching RMB 1.2 billion. As for different types of enzymes, a key raw material in IVT processes, several domestic suppliers, such as Nanjing Vazyme Biotech, Shanghai Kactus Biosystems, or Suzhou Novoprotein, had largely met the domestic demand.

Source: CITIC Securities, official websites of companies.

Nonetheless, to achieve self-reliance, key breakthroughs are still needed in the R&D of raw materials and equipment (such as microfluidic devices or impingement jets mixing skids) used in producing LNPs – i.e., the mainstream delivery system of mRNA. So far, very few domestic upstream suppliers, such as SINOPEG, Jenkem Technology, AVT Pharmaceutical Technology, or Micro&Nano Biologics, are working on the raw material lipids and equipment for LNP formulation.

As a domestic Big Pharma, CSPC Pharmaceutical Group claimed it had self-developed equipment for LNP manufacturing and achieved complete domestic substitution of key lipids. However, most domestic mRNA vaccine companies relied heavily on LNP-related technology introductions, such as CanSino, which partnered with Precision Nanosystems in 2020 on LNPs and microfluidic platforms for vaccine manufacturing.

It should be noted that LNPs have high patent barriers. Both Pfizer-BioNTech and CureVac have taken licenses of LNP patents owned by Arbutus to commercialize their mRNA vaccine globally. In China, Arbutus has applied for 7 patents, effectively covering all domains of LNP production. While obtaining licenses from Arbutus remained a viable solution, domestic vaccine companies have attempted to create their own mRNA delivery systems. Among these, CSPC, Abogen, and Stemirna have achieved notable results, with Stemirna Therapeutics claiming to have developed the world’s first validated and globally licensed LPP (lipopolyplex nanoparticle) mRNA delivery system.

Moving Into the Post-COVID Era

The 2023 Government Work Report delivered during China’s Two Sessions on March 5 said the country would promote the iteration and upgrade of vaccines and the development of new drugs. On the same day, an NMPA official openly affirmed that mRNA is currently the “most advanced vaccine technology”, and the “iteration” is referred to as an upgrade from “traditional inactivated vaccines” to mRNA vaccines.

On March 22, the historic moment came as mainland China finally approved its first mRNA COVID-19 vaccine, SYS6006, with CSPC Pharmaceutical Group becoming the first commercial producer of homegrown mRNA vaccines. Despite being late to the mRNA COVID-19 vaccine development game, CSPC Pharma’s vaccine crossed the finish line in less than a year in clinical trials, beating a host of rivals, including Walwax Biotechnology, CanSino, and Sinopharm. On April 10, shortly after the CPSC shot’s clearance, the National Health Commission (NHC) issued a new COVID-19 vaccination plan in which the mRNA shot was listed as one of its two preferred boosters. It is likely that more homegrown mRNA jabs would be incorporated into the roster of booster shots to protect against new COVID-19 strains, similar to the annual flu jabs, thus creating a stable domestic market for COVID boosters.

The series of development since March has confirmed the government’s firm support for the powerful mRNA technology’s use in mainland China, clearing the way for not only COVID-19 vaccines but also other homegrown mRNA-based prophylactic and therapeutic vaccines, such as LiKang Life Sciences’ LK101, China’s first personalized mRNA tumor vaccine that has been approved to enter clinical trial phases in March. Moreover, domestic biotechs may further explore new disease areas and expand the boundaries of vaccine-preventable diseases, such as chlamydia or acne vulgaris, with their novel mRNA technology platforms to seize the initiative in the vaccine market.

A forecast for the evolution of the market for mRNA technology | Source: Nature

Apart from state-backed Big Pharma such as Sinopharm, which already has a significant global market presence with vaccines receiving the WHO prequalification, several innovative domestic start-up biotechs have also started to leave their footprints in the developing markets of the Global South in search of more opportunities. In September 2022, Walvax and Abogen partnered with Indonesian biotech Etana to transfer a full mRNA technology platform to commercialize AWcorna, an mRNA COVID-19 vaccine, as well as follow-on products in Indonesia. Later, in December, Stemirna Therapeutics’ mRNA vaccine SW-BIC-213 received regulatory approval in Laos. The company us establishing a local manufacturing facility with a planned annual capacity of 20 million doses, supporting the country’s goal of attaining vaccine self-sufficiency.

More than 1.5 trillion yuan (USD 216 billion) of investment has been poured into the Chinese biotech industry since President Xi announced biotech to be one of the 10 key sectors of the country in 2015. Even as China strives towards becoming a technological powerhouse, prodigious investment alone cannot transform the sector when there remains a lack of basic research and an overall reluctance to take risks. For the next step, as Peng Yucai, the chief scientist of AIM Vaccine commented, the nascent mRNA vaccine sector still awaits key breakthroughs in its major pain point – i.e., technology patents related to producing mRNA delivery systems. In this case, governmental support would be crucial. Zhu Tao, political advisor and chief scientist of CanSino has called for more active governmental policy guidance in favor of vaccine innovations to better support the industry. Zhu suggested establishing stable financial support and procurement volume and price agreements for vaccines that might be included for emergency use. Policies such as granting continuous land purchase and lease subsidies, promoting talent attraction and retention, offering tax reliefs and tariff exemptions are all critical, especially as domestic mRNA vaccine companies attempt to transit into the post-COVID era and bridge the gap with the industry giants in the West.

About The Author

Justin Wu

Justin Wu is an Intern at Bridge Consulting. With a background in International Relations at the University of Nottingham and University College London, Justin is eager to promote China’s role as a globally engaged actioner in human health and development via a wide range of communications work to break the information barrier between China and the world. Find Justin on LinkedIn.