Advancing China’s vaccine industry through domestic innovation and R&D

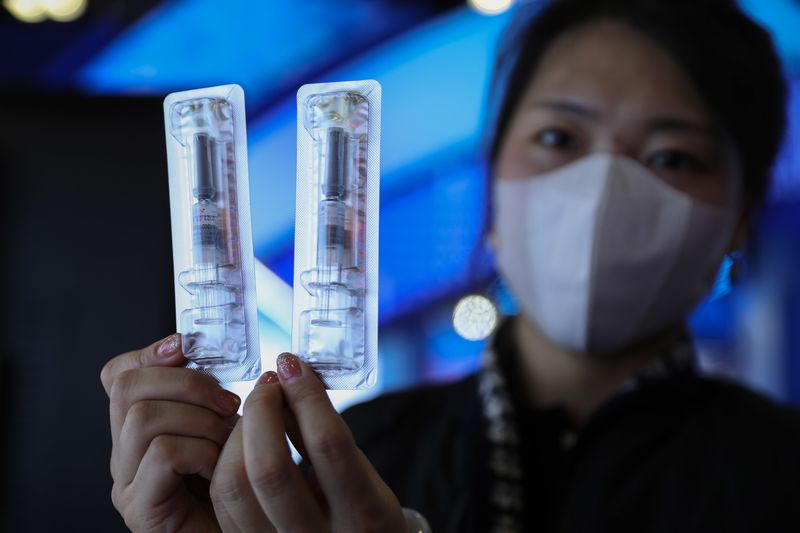

mRNA prototype from CNBG at a Scientific and Technological Innovation Exhibition in China | Source: New York Times

September 14, 2022 | Nandika Nair, 2022 Summer Intern, Bridge Consulting

In this article, we touch upon:

- The advancement in China’s vaccine R&D over time and after the COVID-19 outbreak

- The development of Chinese vaccines based on more advanced, modern technologies

- The increased engagement between Chinese vaccine developers and international collaborators

Following the pandemic outbreak, Chinese vaccine manufacturers quickly became one of the top COVID-19 vaccine exporters, boosting global vaccine supply. However, while their inactivated vaccines were often well received in the developing world, where vaccine hoarding by developed countries left them in urgent need of vaccines, the same inactivated vaccines were often criticized for their low efficacy.

When approved by the World Health Organization (WHO) for Emergency Use Listing (EUL), these vaccines, namely from Sinopharm and Sinovac, only reported 60-70% efficacy rates compared to mRNA vaccines with their >90% efficacy. This left many researchers debating over which studies were the most representative of the vaccines’ efficacy, and brought a lot of confusion over why China, despite their technological advancement, was not producing more effective vaccines such as novel mRNA vaccines.

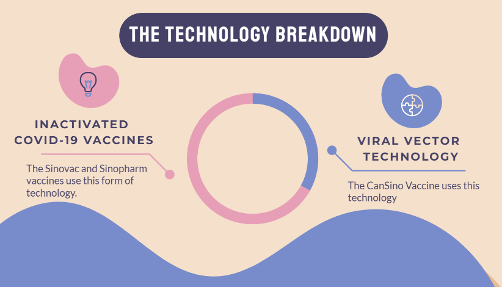

The breakdown between traditional vs. modern technology in the vaccine industry | Source: Bridge Consulting

One reason for this that helps to answer this puzzle is that pre-pandemic China relied heavily on traditional – inactivated – vaccine technologies mainly due to its outsized role in China’s vaccine industry. But post-pandemic, Chinese vaccine manufacturers, researchers and vaccine-related government entities recognized this shortcoming and began investing heavily into the R&D of a wide variety of vaccine technologies, including novel ones – many of which are currently undergoing testing and clinical trial phases.

As such, the advent of COVID-19 played a pivotal role in speeding up innovation and other forms of R&D in this sector, ushering in a new age of vaccine development in China.

Evolution of China’s vaccine industry over time

China’s vaccine industry has always been smaller and less mature than its US, European, or Indian counterparts. However, over the past decades, it has rapidly grown to become one of the only developing countries able to manufacture and supply the majority of all vaccines used in its domestic immunization program. Since 2015, China has manufactured at least 700 million vaccines annually, and from 2016 to 2019, its vaccine market almost doubled in size, going from USD 340M to USD 610M.

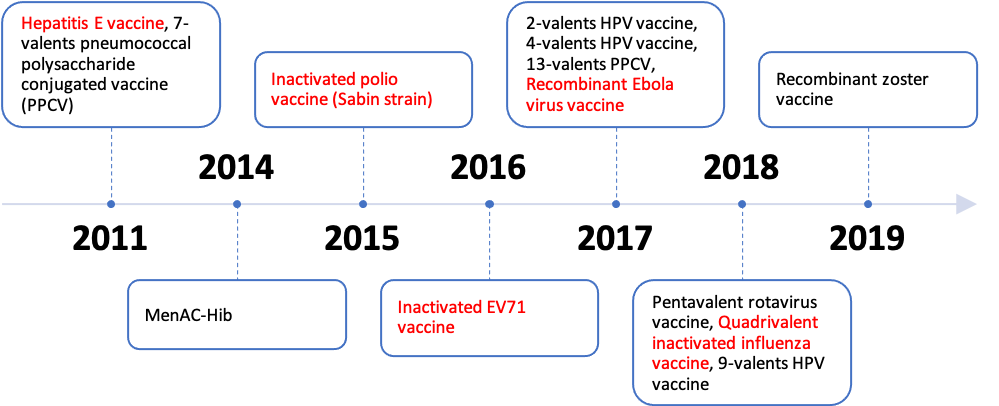

The technology breakdown of the 13 Newly Marketed Vaccines in China before the pandemic. All of these vaccines use traditional technology | Source: NCBI

In 2018, China’s vaccine industry received the second-highest funding in the world for vaccine industries from government and private equity funds. So far, more funding has come from private equity funds, which now support most of its R&D efforts. From the government side, it named biopharma as one of eight critical strategic industries to develop in two of its most recent five-year plans.

To achieve this, it aimed to place more focus on four key structural changes:

- Provide more capital funding

- Enact improved policies to improve market access and support innovation

- Support infrastructure development for science parks and city hubs for innovation and R&D

- Improve market dynamics to attract and retain talent

In parallel to the investment and manufacturing growth, the pre-pandemic R&D sector of the Chinese vaccine industry leaned on the conservative side. Analyzing the technology breakdown of vaccines developed and marketed by China during this period can help to understand their R&D focus. All 13 of the vaccines newly marketed in the country during 2011-2019 employed traditional vaccine technology rather than modern technologies, with China independently developing 5 out of 13 of these vaccines.

The vaccines newly marketed in China from 2011-2019 are in the table below. Highlighted in red are vaccines that were researched and developed in China | Source: NCBI

What has changed due to COVID-19?

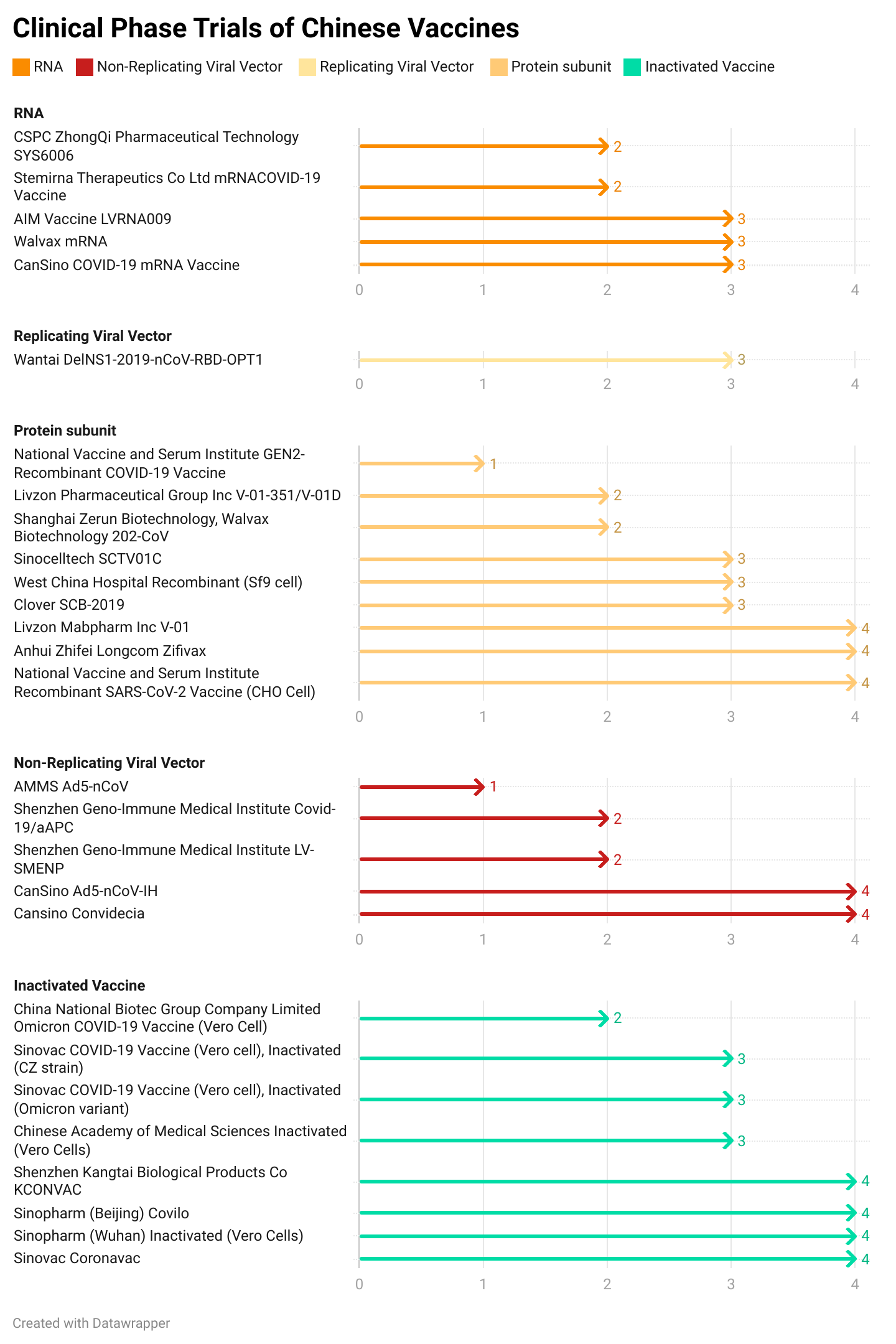

On the surface, China is still primarily using inactivated vaccines to develop vaccines, including those used in its fight against COVID-19. However, it has embraced different technologies in its COVID-19 vaccine development, with the Chinese government having laid out five technical routes in its plan for COVID-19 vaccine R&D. In addition to inactivated vaccines, it has also deemed adenovirus vector, recombinant protein, attenuated influenza virus vector, and nucleic acid (such as DNA or RNA) vaccines as potential solutions.

Inactivated vaccines make up 2/3 of the WHO EUL vaccines from China | Source: COVID19 Vaccine Tracker

Meanwhile, in addition to Sinovac and Sinopharm who use inactivated technology, the WHO has already given its EUL approval to one viral vector vaccine – Convidecia from CanSino – which creates proteins within the body to generate an immune response to COVID-19. Despite their complexity, these novel vaccine technologies typically have higher efficacy rates and produce more robust and durable immune responses than traditional vaccines.

New players, new methods

While Sinopharm and Sinovac long dominated the domestic vaccine R&D market, the development of booster vaccines against Omicron has been a promising opportunity for new Chinese vaccine developers to venture into non-traditional vaccine R&D – with Sinopharm and Sinovac attempting to follow suit.

China initially pushed for the use of homologous boosters, with the WHO confirming this need in October 2021. However, by early 2022, studies had demonstrated that inactivated vaccines as boosters were of limited and short-lived effect. In February, the National Health Commission approved using CanSino and Anhui Zhifei vaccines as sequential ‘mix and match’ boosters. These vaccines – protein subunit and viral vector – were rolled out to counter the waning herd immunity and the continued mutation of the virus.

Currently, Chinese vaccine developers have been developing more RNA and viral vector vaccines, aiming to present them as boosters or variant-specific shots that may have the upper hand in efficacy rates over inactivated vaccines. This has meant that 71.4% of COVID-19 vaccine currently in development have been using modern vaccine technologies. In addition, a clinical trial is being conducted by China CDC to compare neutralizing antibody titers generated by various Chinese vaccine candidates of different technology platforms as booster shots. These results are likely to inform China’s future decisions on approving booster shots.

This is the technology breakdown of each COVID-19 vaccine that is going through the research and development pipeline in China. The results are grouped together by technology | Source: COVID19 Vaccine Tracker

Furthermore, vaccine developers have been working on different vaccine delivery methods – most promisingly through intranasal pathways. Currently, in clinical trials in Malaysia, and having been approved by the Chinese authorities for emergency use as a booster in September, CanSino’s inhaled version of their Convidecia vaccine assures efficacy against Omicron while requiring a lower dosage than traditional intramuscular vaccines. These nasal vaccines work especially to enhance mucosal immunity and counter Omicron’s transmission through the airways.

Looking outwards to international partners for greater collaboration

As China looks at a widening variety of its vaccine development technologies, not only will it have an impact on how its domestic industry improves, but it will also shape how Chinese vaccine developers interact with the global industry.

As a byproduct of China’s domestic zero-COVID efforts, many companies have had to partner with collaborators abroad to conduct Phase III clinical trials that require larger population samples with exposure to COVID-19. This was a rare sight for the industry before the pandemic. Still, pursuing novel technologies has meant that Chinese vaccine developers are relying more on international partners to support the research and biological ingredients needed to develop non-traditional vaccines. Even more, both inactivated vaccines developed by China have been produced overseas through joint production through leveraging international partners such as Brazil’s Butantan Institute and Indonesia’s Bio Farma.

Prototype of COVID-19 mRNA vaccine by Walvax Biotechnology | Source: Bloomberg

In addition, Chinese developers have realized the necessity of marketing their vaccine products to an international audience. For one, increasing the potential of revenue outside of China, where free vaccination has forced prices down, and where the domestic market is already occupied by heavyweights such as Sinovac and Sinopharm.

Chinese companies have applied to international organizations such as CEPI for funding and support in producing novel vaccines for a global market. The Chinese government has also accelerated its involvement in intergovernmental organizations such as the BRICS Vaccine R&D Center to advance pandemic preparedness initiatives.

Cuba and China file the first patent for their pan-variant COVID-19 vaccine | Source: Cuba Debate

Just recently, at the 12th East Asia Summit Foreign Ministers’ Meeting, Chinese Foreign Minister Wang Yi ‘urged support for ASEAN in building regional vaccine production and distribution centers and strengthening capacity building in public health’. Bilaterally, China is increasingly willing to work with other developing countries on innovative products. For example, a China-Cuba collaboration to create a novel pan-variant vaccine that is able to target multiple variants of COVID-19 and other strains from the coronavirus family.

Implications for China’s vaccine industry based on current trends

Beyond COVID-19 vaccines, the use of different types of vaccine technologies will have notable impacts on the trajectory of vaccine development in the future. With current COVID-19 mRNA vaccines proving to be more effective than inactivated ones, experts believe that such novel technologies can be adopted to fight other types of diseases as well, including infectious diseases like the flu, Ebstein-Barr virus, respiratory syncytial virus (RSV) as well as more complex diseases like cancer, HIV, and even antibiotic resistance.

A number of Chinese developers have already started research in these areas, with Walvax including herpes zoster, influenza and RSV virus mRNA vaccines in their vaccine pipeline. Meanwhile CanSino has planned to finish the construction of an mRNA vaccine manufacturing base by the end of 2022, with the intent to develop the mRNA platform technology as a delivery system for a wide range of vaccines outside of COVID-19. However, even as they anticipate the use of mRNA for these other diseases, they have acknowledged the need for greater domestic investment in the mRNA supply chain, as a number of critical equipment and ingredients for these vaccines remain heavily reliant on imports.

Looking ahead

Given these developments, China’s increased presence in the global vaccine market is highly likely to improve the accessibility of newer vaccines and technology to other countries. This has been an important goal for China since the beginning of the pandemic. Based on its leading role in South-South cooperation, China has constantly advocated for working with developing countries to provide them with access to medical and health resources, whether masks or vaccines.

Up to now, China has allocated around 75% of its exported COVID-19 vaccines to low-income or lower-middle-income countries. In addition, China has worked with international pharmaceutical companies to fill and finish Chinese COVID-19 vaccines and build up vaccine-producing infrastructures, supporting various countries and regions in their goal of attaining vaccine self-sufficiency.

If China continues to advance its vaccine industry with innovative and quality products, it can help different types of vaccines and biotech technologies become more accessible to the developing world. More importantly, it can have positive and rippling effects in the global health space for years to come.

About The Author

Nandika Nair

Nandika Nair is a Research Analyst Intern at Bridge Consulting. With a background in Biomedical Engineering and International Science Policy at Cornell University, Nandika has a strong interest in exploring global health phenomenon through research and data analysis. Find Nandika on LinkedIn.